Timber Industry Statistics (Updated 2024)

Now we are in 2024, we here at Timbersource are very excited to see what the year will bring. Below, we have collated some of the most noteworthy data in the industry relating to timber and forestry, as well as answering some of the most common questions people ask online about timber. If you have any questions, do get in touch with the team at Timbersource who will be willing to answer any of your enquiries.

Does timber rot?

One of the most common questions includes if timber rots. Whilst yes it can, this purely depends on the environment it’s based in, as well as its durability. According to USDA.GOV, wood will decay above 30% moisture content and will not decay below 20% moisture content.

Does timber expand in heat?

Another question that is often asked on search engines is the question, does timber expand in heat. Wood can expand in heating and contracts on cooling, so you need to consider the temperature of the environment so you know if the size of the wood will change. This also needs to take into account the humidity and moisture levels in the space. Timber shrinks and swells in the tangential direction, about half as much in the radial direction, and about 0.1% to 0.2% in the longitudinal direction. (Source: Forestry and Natural Resources)

Does timber absorb sound?

Yes, timber wood can absorb sound, making it a great addition for recording in a music studio, as well as architectural buildings. Plywood for example can absorb 0.02 to 0.04 decibels in the whole low frequency range, according to Core.

Have timber prices changed over recent years?

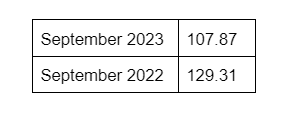

According to TDUK Market Data, the cost of timber wood has actually decreased. The price index below shows a slight decrease from 129.31 in September 2022, to 107.87 in September 2023. It will be exciting to see what happens as we progress through 2024!

Which industry demands the most timber?

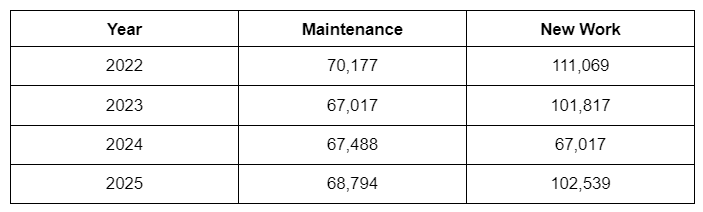

One question that is often asked is which industry demands the most timber. According to Timber Development UK, the construction industry is the most demanding. The table below shows some if the demand is for maintenance or new work, as well as the projections for the future courtesy of the Construction Products Association (CPA).

These figures suggest that the demand for timber for both maintenance and new work has been consistent over the last few years, and is looking to stay stable over the next couple of years. Please find some additional statistics relating to timber below:

General Timber Sale Prices for 2024:

The Coniferous Standing Sales Price Index was 28.1% lower in real terms, and 22.6% lower in nominal terms in September 2023. (Source: Timber Price Indices).

Softwood Sawlog Price Index was 23.7% lower in real terms. (Source: Timber Price Indices).

The Small Roundwood Price Index was 16.1% lower in real terms. (Source: Timber Price Indices).

Where Softwood has been removed in different parts of the UK:

It is estimated that 72% of all softwood removals from private sector woodlands were harvested in Scotland, 17% in England, 10% in Wales and the remainder in Northern Ireland in 2022. (Forestry Statistics, Page 9).

With the UK being the second largest importer of timber in the world, (2023 we imported 7,336.88, in comparison to 2022 which was 9,325,02), the fact that there is a reduction in the amount of timber imported with a price reduction could suggest less demand for timber, which could be down to consumer spending power. 2023 has been the lowest year since 2016.

It’s important to note however that this dip is marginal, and the price may suddenly increase again as we go into 2024.

One reason could be down to choppy waters in the construction industry. The graph shows how much the construction industry dipped during Q4 of 2022, and 2023 would have been spent recovering from this. (Source: Construction Management).

Hardwood vs Softwood

Another interesting trend shows the harvesting of soft vs hardwood. In 2023, the data shows there was a far less amount of hardwood being harvested, than softwood. The data below looks at the removals of UK roundwood in 2023, as well as the production of wood products in the UK. (Forestry Statistics).

Removals (harvesting) of UK roundwood in 2023:

• 9.2 million green tonnes of softwood (-11%)

• 0.8 million green tonnes of hardwood (1%)

Production of wood products in the UK included:

• 3.1 million cubic metres of sawnwood (-13%)

• 3.5 million cubic metres of wood-based panels (-1%)

• 3.5 million cubic metres of paper and paperboard (-5%)

When it comes to the production of wood products in the UK, there has been a 13% decrease in the production of sawnwood.

Forestry Market Predictions for 2024:

There are several predictions for how 2024 will play out in the forestry market. Some of these include:

In the USA, the import value in Forestry is projected to amount to US$14.7bn in 2024, with an annual growth rate of 6.54%. (Statista).

The export value of forestry is valued to be at US$3.0bn, with an annual growth rate of 5.33%.

Predictions in the UK for 2024:

According to Savills UK, the slow growth during 2023 (thanks to 2022 external pressures) is set to shift to steady capital growth in 2024 of 2.5%. (Source Savills UK).

UK timber demand is expected to increase by 78% by 2025. (Global Wood Markets UK).

According to TDUK Statistics, timber import volumes continued to improve as the year progressed in 2023. (Source: Building Design & Construction Business).

We hope you have found this article insightful and can help you answer any of the key questions asked in the timber industry. If you have any further questions regarding timber wood, then do not hesitate to get in contact with a member of our team.